Discover expert developed MetaTrader tools that can complement professional solutions.

Overview

This is a scanner + visualizer. It does not place trades.

What the Indicator Detects

A signal is produced when a candle meets configurable rejection rules, including:

-

Dominant wick (upper or lower) as a percentage of the full candle range

-

Minimum candle range filter to avoid tiny/noisy candles

-

Minimum body size to avoid meaningless “needle” bars

-

Opposite wick cap to avoid “indecision” candles with large wicks on both sides

-

Optional ATR filter so signals occur only during sufficient volatility

-

Optional Trend Context score to penalize signals occurring in weak locations inside the recent range

The result is a set of rejection signals that is designed to be realistic, not overly sensitive.

Key Features

-

Multi-Symbol Scanner

-

Scan symbols from Market Watch or from a custom comma-separated list

-

Limit the number of scanned symbols for performance control

-

-

Multi-Timeframe Support

-

Scan the current chart timeframe or a fixed timeframe

-

Optional additional scans for M15 and H4

-

-

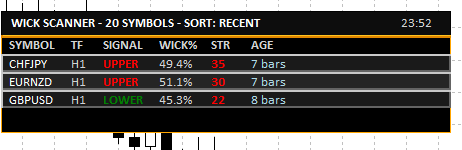

Professional Dashboard UI

-

Clean dark theme dashboard with consistent spacing and alignment

-

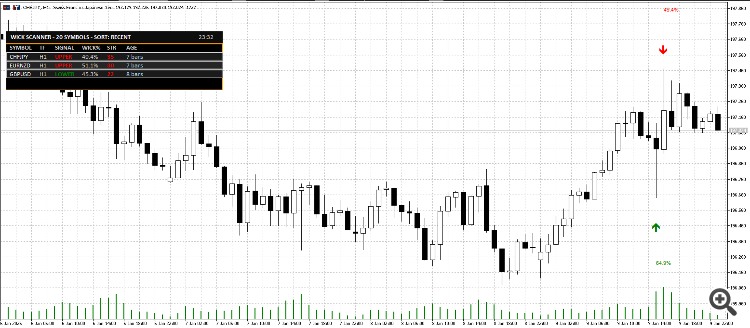

Displays: Symbol, Timeframe, Signal Type, Wick %, Strength, Age

-

Sorting modes: Most Recent / Highest Wick% / Highest Strength

-

Shows a compact signal age (bars ago or time for very recent signals)

-

-

Click-to-Switch Chart

-

Click a dashboard row to instantly switch the chart to that symbol + timeframe

-

-

On-Chart Markers (Optional)

-

Draw arrows on the chart for detected signals

-

Optional wick percentage labels

-

Maximum marker count for performance and readability

-

-

Alerts (Optional)

-

Popup / Push / Email alerts

-

Cooldown control to avoid repeated alerts for the same symbol/timeframe

-

Typical Use Cases

-

Watchlist scanning for rejection candles at important levels

-

Quick filtering before manual confirmation (S/R, trend structure, session timing, liquidity sweeps)

-

A dedicated “setup radar” on a secondary monitor

Notes and Best Practice

-

A wick rejection candle is a trigger, not a complete strategy.

-

For higher quality trade decisions, combine signals with:

-

Support/Resistance zones

-

Trend structure (HH/HL or LH/LL)

-

Higher timeframe bias

-

Session timing / volatility conditions

-

Inputs (What You Can Configure)

Detection Settings

-

Wick threshold (% of candle range)

-

Minimum candle range (points)

-

Minimum body percentage

-

Maximum opposite wick percentage

-

ATR-based validation (period + multiplier)

-

Trend context scoring (lookback + threshold)

Scanner Settings

-

Market Watch symbols or custom symbol list

-

Scan timeframe selection (or current chart timeframe)

-

Optional extra timeframes (M15 / H4)

-

Bars to check + refresh interval

-

Optional limit for maximum displayed signals

UI & Alerts

-

Dashboard position, offsets, row height, font size

-

Marker visibility, label visibility, max markers

-

Alert channels and cooldown

Summary

If you trade wick rejections and want a faster workflow, Wick Rejection Scanner Dashboard helps you:

-

scan more charts in less time,

-

reduce noise using practical filters, and

-

focus on the best candidates via strength scoring and sorting.

Reduce lag and improve accuracy with the NonLagMA Expert Advisor for MT4/MT5. Discover it.

Build better strategies with RobotFX professional tools – check them out.

68101