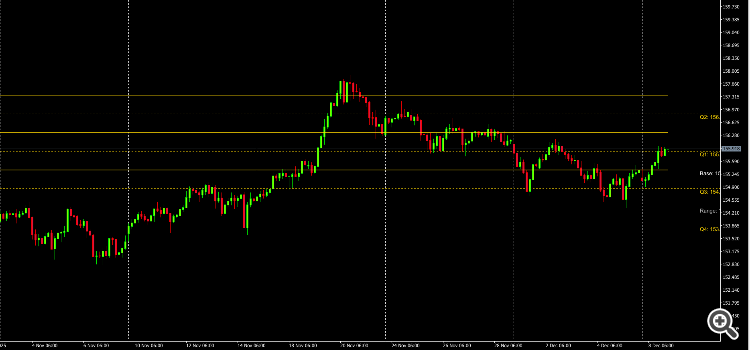

This indicator implements the "Quarters Theory" - a technical analysis concept that divides price movement into four quarters around a central base level. It's designed to work with multiple asset types (Forex, stocks, commodities, etc.) and provides visual quarter levels on the chart.

Quarters Theory Concept:

-

Base Level: Central reference price

-

Quarter 1: Price range from Base to Base + Quarter Range

-

Quarter 2: Price range from Base + Quarter Range to Base + 2*Quarter Range

-

Quarter 3: Price range from Base - Quarter Range to Base

-

Quarter 4: Price range from Base - 2*Quarter Range to Base - Quarter Rang

1. Flexible Base Level Calculation:

-

Current Daily Close: Latest closing price

-

Previous Day Close: Yesterday's closing price

-

Previous Week Close: Last week's closing price

-

Previous Month Close: Last month's closing price

-

Weekly/Monthly Open: Start of week/month price

-

Custom Level: User-defined price level

-

-

Pips: Forex-specific measurement

-

Points: Smallest price increment

-

Percentage: Percentage of base level

-

Absolute: Fixed price value

-

Automatically detects Forex vs. other instruments

-

Adjusts pip calculations for different symbol formats

-

Handles unavailable timeframes gracefully

2. Multiple Quarter Size Units:

3. Multi-Asset Support:

Trading Applications:

Support/Resistance:

-

Quarter boundaries act as dynamic support/resistance

-

Middle lines as potential reversal points

Trend Analysis:

-

Price in Quarter 1/2 suggests bullish bias

-

Price in Quarter 3/4 suggests bearish bias

-

Quarter transitions indicate trend changes

Range Trading:

-

Trade bounces between quarter boundaries

-

Look for reactions at quarter midpoints