The two moving averages crossover strategy is one of the most common trading strategies in the financial market. It is based on the use of two moving averages (usually a long term and a short term) and signals an entry into a position based on their intersection.

- Selection of moving average periods: The trader selects two periods for the moving averages. For example, it could be the 50-day and 200-day moving averages.

- Defining Signals: When a short-term moving average (e.g. 50-day) crosses a long-term moving average (e.g. 200-day) from bottom to top, this can be considered a buy signal (long position) as it may indicate the beginning of an uptrend. Conversely, a short-term moving average crossing a long-term moving average from bottom to top may be considered a sell signal (short position).

- Risk Management and Stop Loss Levels: A trader may also consider introducing stop loss orders to manage risk. For example, a stop loss can be set at a certain percentage of the current price to protect against large losses in the event of an unfavourable price movement.

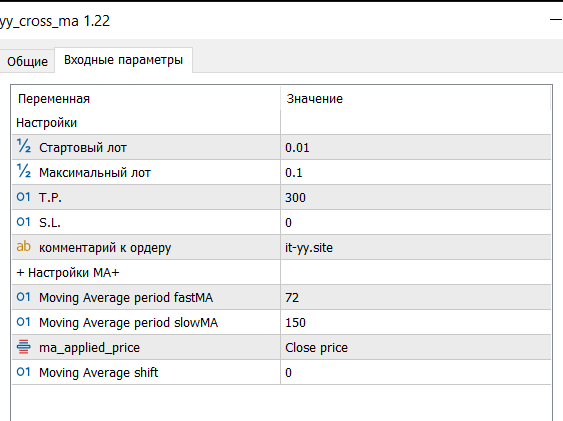

Input parameters

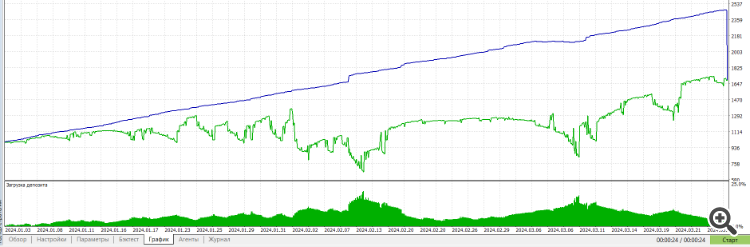

unoptimised test

developer's website https://it-yy.site/