Author: Andrey N. Bolkonsky

Ergodic DTI-Oscillator (based on Directional Trend Index) is described by William Blau in the book "Momentum, Direction, and Divergence: Applying the Latest Momentum Indicators for Technical Analysis".

- WilliamBlau.mqh must be placed in terminal_data_folder\MQL5\Include\

- Blau_Ergodic_DTI.mq5 must be placed in terminal_data_folder\MQL5\Indicators\

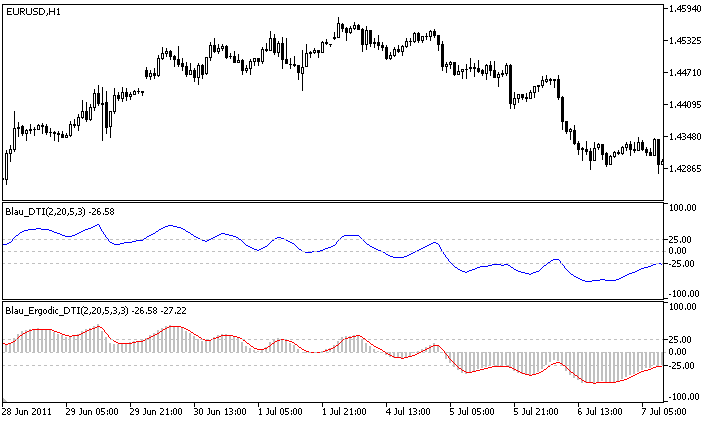

Ergodic DTI-Oscillator by William Blau

Calculation:

The Ergodic DTI-Oscillator is defined as follows:

Ergodic_DTI(q,r,s,u) = DTI(q,r,s,u)

SignalLine(q,r,s,u,ul) = EMA( Ergodic_DTI(q,r,s,u) ,ul)

where:

- Ergodic_DTI() - Ergodic Line - Directional Trend Index DTI(q,r,s,u);

- SignalLine() - Signal Line - EMA(ul), applied to Ergodic Line;

- ul - smoothing period of a Signal Line.

- graphic plot #0 - Ergodic Line (Directional Trend Index тренда):

- q - number of bars, used in calculation of DTI (by default q=2);

- r - period of the 1st EMA, applied to DTI (by default r=20);

- s - period of the 2nd EMA, applied to result of the 1st smoothing (by default s=5);

- u - period of the 3rd EMA, applied to result of the 2nd smoothing (by default u=3);

- graphic plot #1 - Signal Line:

- ul - smoothing period of a Signal Line - EMA(ul), applied to Ergodic (by default ul=3);

- q>0;

- r>0, s>0, u>0. If r, s or u are equal to 1, smoothing is not used;

- ul>0. If ul=1, the Signal Line and Ergodic Line are the same;

- Min. rates = (q-1+r+s+u+ul-4+1).