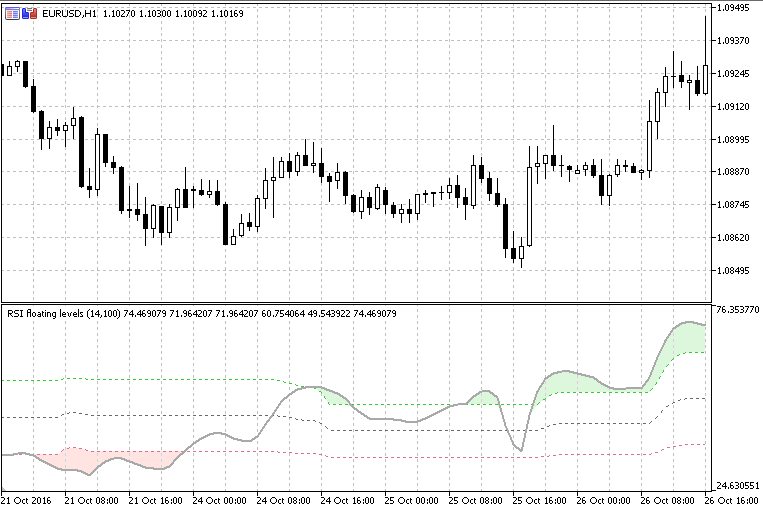

It is obvious that all of a sudden RSI can be a trending indicator

(since even on longer calculating lengths levels are kept at usable

values) and that the problem of flattening is, at least in its bigger

part, solved this way. That way it is giving a bit of a "new life" to

the good old RSI.

Added the filled array for overbought and oversold zones. Also added choices of rsi calculation (the "regular" rsi, Wilder's rsi, rsx

and Cuttler's rsi) as well as jurik smoothing to the rsi value. Just one

additional observation: since the levels are "floating in this one and

since that way the "flattening effect" is avoided in the greatest part

of it, it is interesting to use long rsi periods for calculation too

without losing "signals".