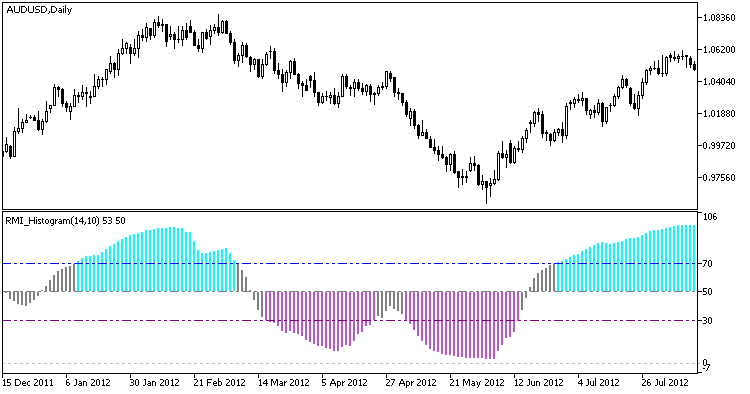

Relative Momentum Index implemented as a color histogram with an indication of overbought and oversold zones.

RMI (Relative Momentum Index) was developed by Roger Altman and was first published in 1993 in the 'Technical Analysis of Stocks&Commodities' magazine. RMI is a stochastic, which can be used for improving the quality of Relative Strength Index (RSI). It generates signals when the price reaches the overbought or oversold zone.

Fig.1. The RMI_Histogram indicator