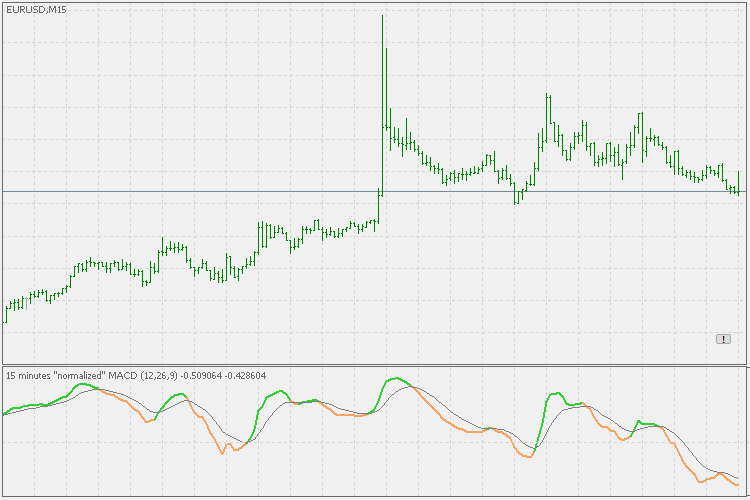

This indicator is almost same as the

"normal" MACD, except that its values are normalized and are roughly

falling into a predictable range of values (unlike the regular nacd,

that does not have that predictability of expected ranges). That makes

it usable for direct value-to -value comparison over different

instruments and / or timeframes (since the values are comparable now).

17298

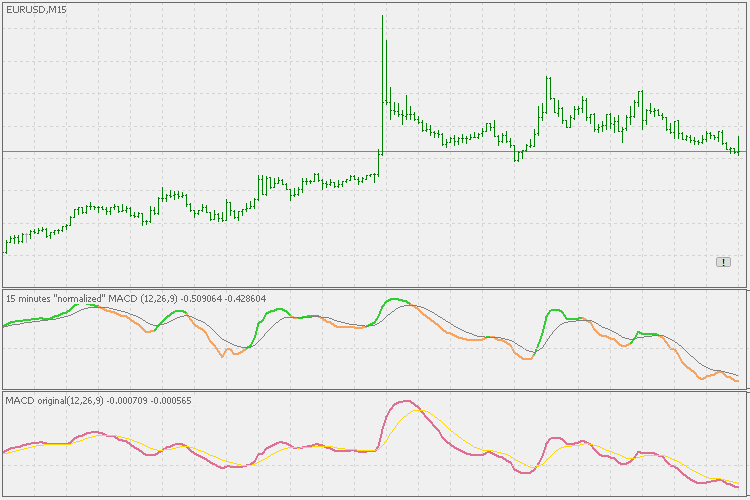

Even

though the values are "very similar" to the original MACD, the values

can differ significantly — see the example: lower is the "regular"MACD , and, as it is obvious, it is quite different in some periods of

elevated volatility from the normalized version (not just regarding

values, but the slope as well as the signal values).

It should be used using the same rules as regular MACD, but some experimenting is advised.