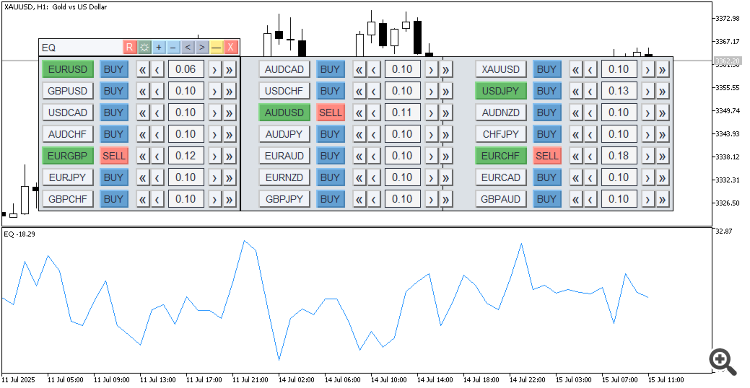

Interface development of the previous version of the indicator:

+ Automatic tracking of "Market Watch", adding and deleting symbols

+ Automatic rendering of any changes in active symbols

+ Automatic temporary saving of settings when deleting or switching off the terminal

+ Interface: reset, colour theme, mashstabbing, split into bars, minimise, close (deleting from the indicator chart)

OBJECTIVE:

- To identify volatility-flattening constructs for spread/equity trading

- visual analysis of spread trading efficiency

- identification of entry/exit moments for equity trading

- volume and direction are set once for each active pair

- cumulative profit/loss from all positions is calculated

- the result is displayed as an equity line in the subwindow.

- Set volumes, directions and activation of pairs

- Set the depth of the drawing history (in bars)

- Set initial balance (optional)

NOTES:

- spread, commission and swaps are not included in the calculations.

At present, this is an experimental sample on a poorly disclosed technique of profit extraction from spread/equity trading.

There are no definitions, no instructions, knowledge on the subject is fragmentary and contradictory in some places.

I decided to write to understand thesubject.

Currently forum activity on thesubjectis here: https://www.mql5.com/ru/forum/475752

FURTHER STEPS:

.

- Visual analysis of the effectiveness of flat strategies "from channel boundaries": adding optional Bollinger/Converts/Dynamic Levels and others

- Automation of identifying the best (or best) portfolio/basket designs for spread/equity trading, the main thing: finding or creating a suitable formula for this (I'm not good at maths, this is the hardest part).

- Algorithmisation of trading (creation of the EA itself) with favourable results

PS:

Either here or in the https://www.mql5.com/ru/forum/475752 thread, you can share your opinions/knowledge/comments on the topic and on the indicator. Somebody's implementation of the indicator will be even better.