Here is a version that, in some way, combines the two types.

Discontinued

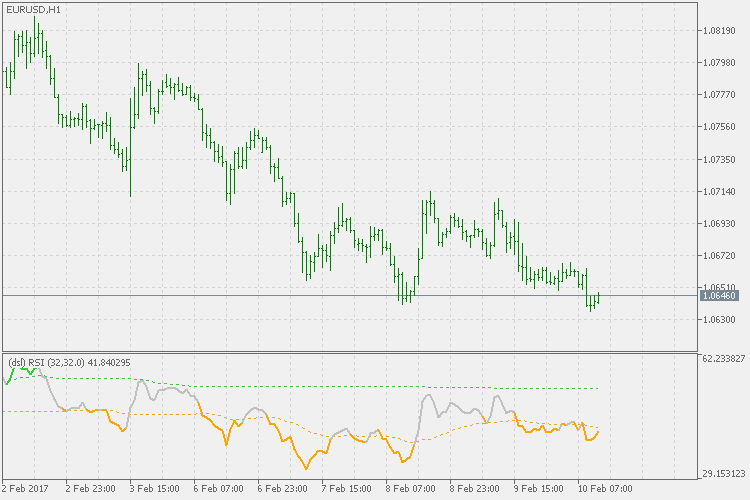

signal lines idea is simple : when RSI value is above central value

(RSI being 50), then only the upper signal line is calculated, and the

lower signal line value is "inherited". When the value of RSI is below

central value then the lower signal line is calculated and the upper

signal line is "inherited". That way we are getting a kind of

combination of levels and signal lines without a need to change the

value of the RSI itself. As it is obvious it has its better sides

compared to both methods (especially avoiding some problems with

"trends" when signal lines alone are used). In any case extensive

testing is advised.