Larry Williams' WILL VAL oscillator.

It has six input parameters:

- Instrument - instrument name, relative to which the calculation is made

- First EMA period - first exponential smoothing period

- Second EMA period - second exponential smoothing period

- Period - indicator calculation period

- Overbought - overbought level

- Oversold - oversold level

Calculation:

WV = 100.0 * (Value - Min) / (Max-Min)

where:

Value = MA1-MA2 MA1 - EMA(Price, First EMA period) MA2 - EMA(Price, Second EMA period) Max, Min - maximum and minimum 'Value' values in the Period range Price = Close(Current Instrument) / Close(Instrument)

Keep in mind that the indicator needs to upload history data of a selected instrument during the first launch or when changing 'Instrument'. If the re-drawing does not occur quickly or the indicator is displayed incorrectly, simply switch the chart timeframe to accelerate the process and obtain a correct display.

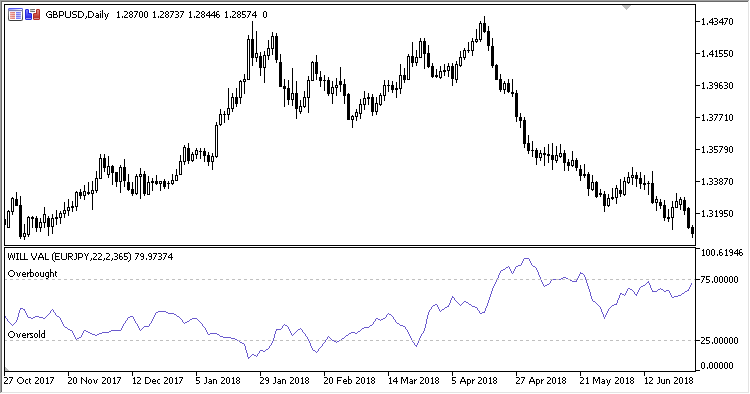

Fig. 1. Calculation relative to EURJPY

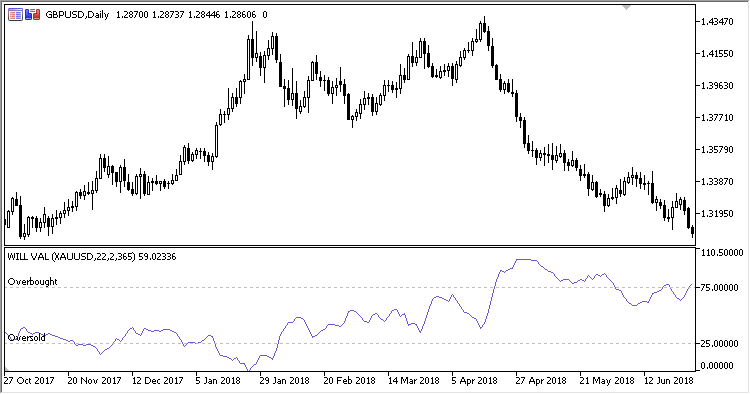

Fig. 2. Calculation relative to XAUDUSD

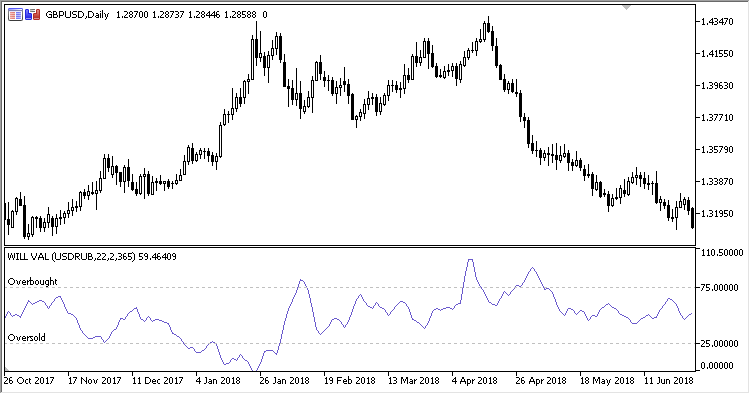

Fig. 3. Calculation relative to USDRUB