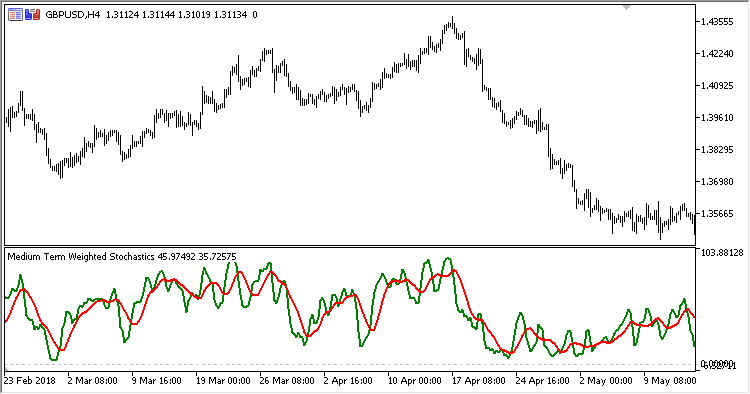

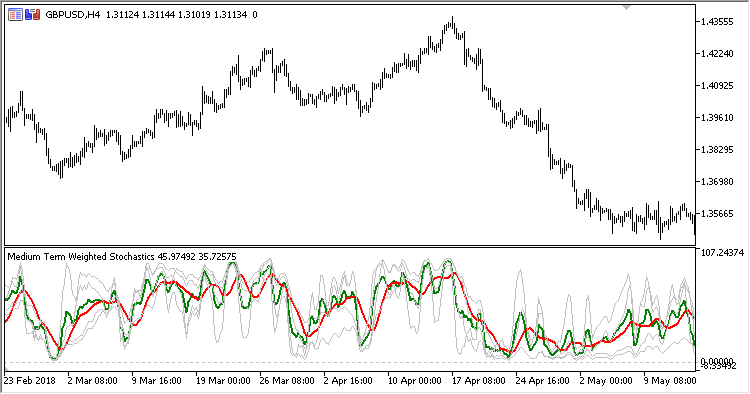

The STPMT (Medium Term Weighted Stochastics) indicator.

The indicator has twenty six customizable parameters, of which 24 parameters are four similar blocks of parameters having six input values for each of the four stochastics used for the calculation:

- Stochastic N %K period - the period of the K line of Stochastic N;

- Stochastic N %D period - the period of the D line of Stochastic N;

- Stochastic N Slowing - the slowdown period of Stochastic N;

- Stochastic N Method - the calculation method for Stochastic N;

- Stochastic N Price field - stochastic N calculation price type;

- Stochastic N Weight - the weight of stochastic N;

- ...

- Signal line period - signal line period;

- Show components - show data of stochastic indicators used for calculation.

Calculations:

STPMT = (Stoch 1 Weight * St1 + Stoch 2 Weight * St2 + Stoch 3 Weight * St3 + Stoch 4 Weight * St4) / SumWeight

where:

SumWeight = Stochastic 1 Weight+Stochastic 2 Weight+Stochastic 3 Weight+Stochastic 4 Weight

St1 = Stochastic(Stoch 1 Price field, Stoch 1 %K period, Stoch 1 %D period, Stoch 1 Slowing, Stoch 1 Method) St2 = Stochastic(Stoch 2 Price field, Stoch 2 %K period, Stoch 2 %D period, Stoch 2 Slowing, Stoch 2 Method) St3 = Stochastic(Stoch 3 Price field, Stoch 3 %K period, Stoch 3 %D period, Stoch 3 Slowing, Stoch 3 Method) St4 = Stochastic(Stoch 4 Price field, Stoch 4 %K period, Stoch 4 %D period, Stoch 4 Slowing, Stoch 4 Method)

Fig. 1. Medium Term Weighted Stochastics

Fig. 2. Medium Term Weighted Stochastics + data of Stochastics used