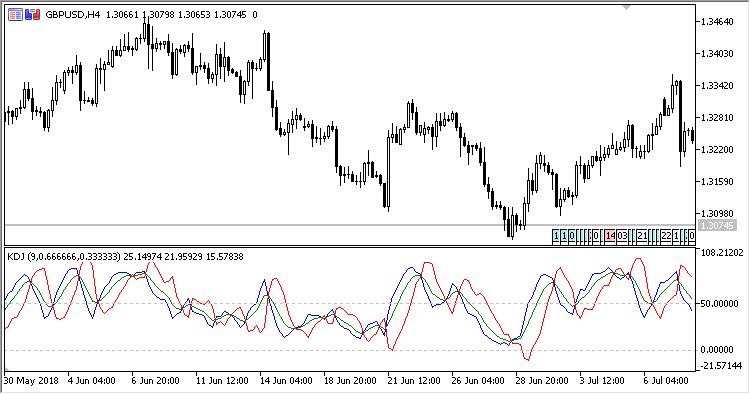

KDJ oscillator defines when it is necessary to search for market entry conditions.

It has four inputs:

- Period - calculation period;

- KFactor - K line calculation ratio;

- DFactor - D line calculation ratio;

- Threshold - signal line.

Calculation:

K = KFactor * PrevK + DFactor * RSV D = KFactor * PrevD + DFactor * K J = 3.0*D - 2.0*K

where:

RSV = ((Close – Lowest Low) / (Highest high – Lowest low)) * 100

Lowest Low, Highest High - the lowest and highest prices within the Period interval

One of possible interpretations: J line crosses the Threshold level. Up - search the possibility for selling, down - search for the appropriate moment to buy.