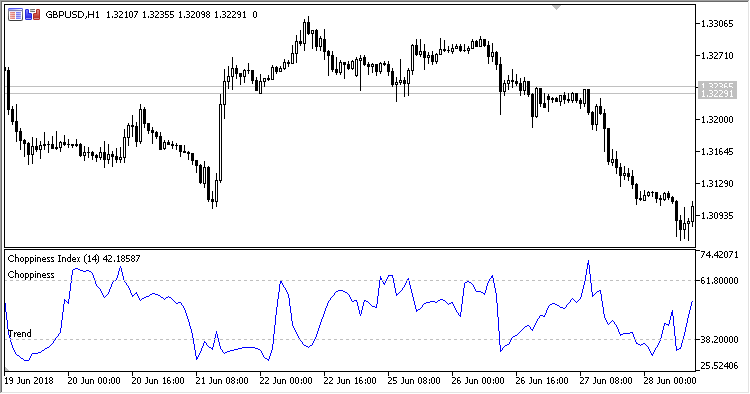

Oscillator Choppiness Index is intended for assessing the market situation. It identifies three states:

- Trend

- Flat

- Instable consolidation

Values below 38.2 indicate a trend on the market, while those above 61.8 indicate a flat market. Values close to 100 indicates an instable consolidation.

the lower the oscillator value is, the more expresed the trend component is on the market.The indicator has four configured parameters:

- Period - calculation period

- Trend level - trend boundary level

- Choppiness level - flat boundary level

- Consolidation level - consolidation boundary level

Calculations:

CI = 100.0 * log10( SumATR / ( MaxHigh - MinLow)) / log10X

where:

log10X = log10(Period) ATR = ATR(1) SumATR - sum of ATR over the Period MaxHigh - maximum High value within the Period MinLow- minimum Low value within the Period