Expert Advisor Parameters (Inputs)

The EA provides several external parameters that the user can modify to control its behavior:

General Parameters

| Parameter | Type | Description |

| MagicNumber | int | A unique identifier for the EA's trades. |

| InitialLot | double | The starting lot size for the first trade in a series. |

| AllowBuy | bool | Flag to allow the EA to open Buy trades (initial and Martingale). |

| AllowSell | bool | Flag to allow the EA to open Sell trades (initial and Martingale). |

| TakeProfit | int | A fixed Take Profit in points/pips used when placing pending orders (though not for market execution). |

| FindHighLowBackBars | int | The number of previous bars to look back for determining the highest high and lowest low for initial pending order placement. |

| ResetAfterBars | int | The number of bars after which the initial pending orders will be deleted and re-evaluated (if no position is open). |

Martingale Strategy

| Parameter | Type | Description |

| ReverseMartingale | bool | If true , the subsequent Martingale trades will be in the opposite direction of the last trade in the series (this would typically be an anti-Martingale or hedging approach, but the code opens in the same direction if false ). The current logic suggests opening in the same direction if ReverseMartingale is false . |

| LotMultiplier | double | The factor by which the lot size is multiplied for the next trade in the loss-making series (e.g., 2.0 means doubling the lot). |

| SecureProfitMartingaleTarget | double | The total floating profit (in account currency) at which the entire series of open trades will be closed. |

| DistanceMartingalePips | int | The distance (in pips) the price must move against the last trade's open price before a new Martingale trade is opened. |

| MaxTradesInSeries | int | The maximum number of trades allowed in a single Martingale series. |

Time Strategy

| Parameter | Type | Description |

| AllowMonday... AllowFriday | bool | Flags to enable or disable trading on specific days of the week. |

| ForbiddenDates | string | A comma-separated list of dates (format YYYY.MM.DD) on which trading is prohibited. |

Core Functions Overview

OnInit() (Initialization)

Sets the EA's MagicNumber , margin mode, and deviation. It resets the Martingale status variables ( s_currentLot , s_totalTradesInSeries , etc.) to their initial values, preparing for a fresh start.

OnDeinit() (Deinitialization)

A simple function for cleanup, printing a message when the EA is stopped or removed.

IsTradingDateAllowed() and IsTradingDayAllowed() (Trading Filters)

These functions check the current day and date against the user-defined inputs ( AllowMonday to AllowFriday and ForbiddenDates ) to determine if trading is permitted.

OpenTradeLogic(ENUM_ORDER_TYPE type, string tradeComment) (Market Execution)

This function handles opening new market positions (Buy or Sell).

-

It validates and normalizes the lot size against the broker's minimum, maximum, and step size.

-

It checks for sufficient free margin using CheckMargin() .

-

It executes the trade without a fixed Take Profit or Stop Loss ( tp_calculated is 0).

-

It updates the global Martingale status variables: s_currentLot , s_lastOpenPrice , s_seriesType , and s_totalTradesInSeries .

CloseAllPositions()

Iterates through all currently open positions and closes any that were opened by this EA (matching the MagicNumber ).

PendingOrders(ENUM_ORDER_TYPE type, double price, double lotSize, string comment) (Pending Order Placement)

This function places Buy Limit or Sell Limit orders:

-

It validates the lot size and checks for sufficient margin.

-

It validates the entry price against the broker's minimum distance ( SYMBOL_TRADE_STOPS_LEVEL ).

-

It calculates a fixed Take Profit ( tp ) based on the TakeProfit input.

-

It sends the trade request. Note: The UpdateHighLowAndOrders function calls this to place initial Buy Limit and Sell Limit orders.

UpdateHighLowAndOrders() (Initial Entry Logic)

This is the initial entry mechanism when no positions are open:

-

It looks back FindHighLowBackBars to find the Highest High and Lowest Low.

-

It calculates priceSellLimit (Highest High + 1 tick) and priceBuyLimit (Lowest Low - 1 tick).

-

It checks if Buy Limit and Sell Limit orders with the EA's MagicNumber already exist.

-

It places an initial Sell Limit order just above the recent highest high and a Buy Limit order just below the recent lowest low, each using the InitialLot .

OnTick() (Main Logic)

The core of the EA's execution logic:

-

Time Check: Prevents redundant calculations on the same tick.

-

Filter Check: If trading is not allowed by day/date, it deletes all pending orders.

-

Profit Target Check (Series Exit): If eaHasOpenPositions is true AND totalFloatingProfit is ≥ SecureProfitMartingaleTarget , it calls CloseAllPositions() and resets all Martingale status variables to start a new series.

-

Initial Order Placement: If !eaHasOpenPositions AND trading is allowed, it resets the Martingale status and checks if a new bar has formed.

-

If a new bar is formed, it checks if barsCount is ≥ ResetAfterBars . If so, it deletes pending orders and calls UpdateHighLowAndOrders() to place new initial orders. If not, it just calls UpdateHighLowAndOrders() .

-

-

Martingale Step Logic: If eaHasOpenPositions is true AND s_totalTradesInSeries is $< MaxTradesInSeries`:

-

It checks if totalFloatingProfit is negative AND the price has moved against the last open trade by at least DistanceMartingalePips .

-

If both conditions are met, it calculates the nextLot by multiplying s_currentLot by LotMultiplier .

-

It determines the orderToOpen direction (either the same direction as the series or the reverse, based on ReverseMartingale ).

-

It calls OpenTradeLogic() to open the new, multiplied position, continuing the Martingale series.

-

Summary of Strategy

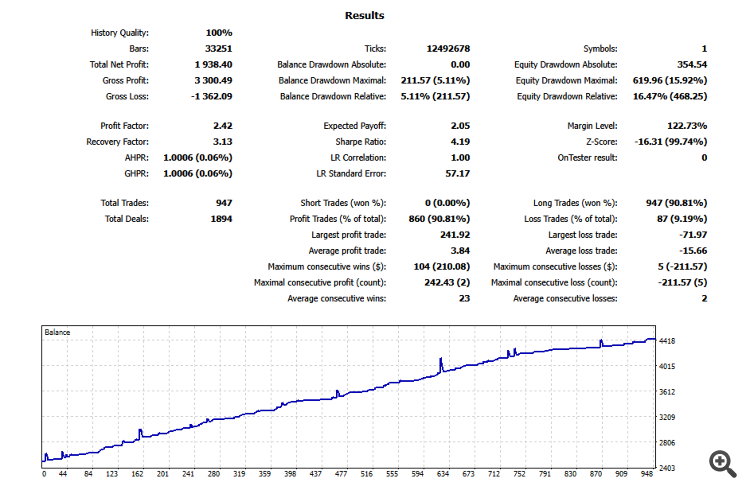

The "Babi Ngepet" EA implements a risky but potentially high-reward Martingale strategy combined with a breakout/range-reversal initial entry:

-

Initial Entry: The EA places an initial Buy Limit (below recent low) and a Sell Limit (above recent high). This suggests an initial assumption of range-bound behavior—it enters a buy when the price drops to a low, and a sell when the price rises to a high.

-

Trade Management: If one of the initial trades is triggered and the position moves into an aggregate loss (negative floating profit), and the price continues to move against the open positions by a defined distance, the EA opens a new position in the same direction with a larger lot size (Martingale).

-

Exit Strategy: The series of trades continues to increase lot size until the aggregate floating profit of all trades in the series reaches the SecureProfitMartingaleTarget , at which point all positions are closed, and the EA resets for a new series.

Warning: The Martingale strategy is known for high drawdowns and high risk of capital loss because the lot size increases after every losing step.