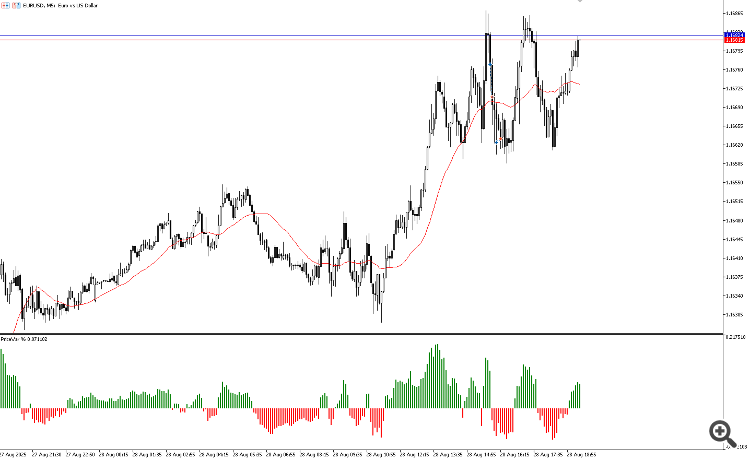

PriceVar% is an indicator designed to measure the percentage difference between the price and a moving average, highlighting the strength of the market movement in relation to a reference value.

How it works

-

If the closing price is above the average, the calculation is:

-

If the closing price is below the average, the calculation is:

Var = (Low - MA) / MA * 100;

The result is displayed as a percentage histogram (%):

-

Green → when the price is above average (buying force).

-

Red → when the price is below average (selling force).

Interpretation

-

Positive values indicate the distance of the high from the average.

-

Negative values indicate the distance of the low from the average.

-

The higher the absolute value, the greater the percentage distance of the price from the average.

Practical applications

-

Identifying moments of overbought/oversold relative to the average.

-

Measuring percentage volatility around the average.

-

Aid in breakout or reversal strategies by validating the intensity of the movement.

-

Use as a filter in automated systems (e.g. only trade when the percentage change exceeds a certain threshold).

Parameters

-

Average period (iPeriod): defines the horizon of the moving average used as a reference.